JP Morgan Sustainable Investing A Deep Dive

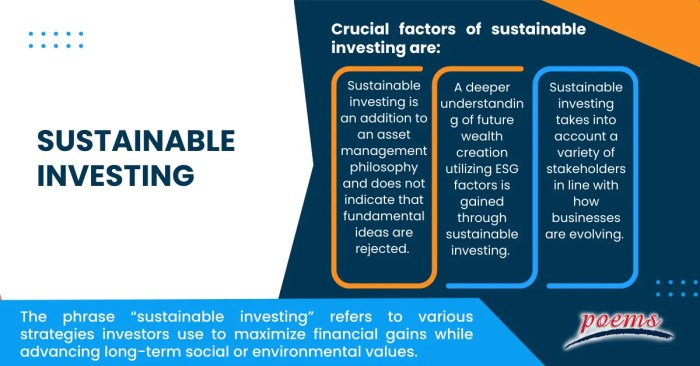

JP Morgan Sustainable Investing offers a compelling glimpse into the future of responsible finance. It’s a comprehensive approach encompassing various investment strategies from portfolio construction to impact measurement. The initiative highlights a commitment to environmental, social, and governance (ESG) factors, emphasizing long-term value creation while addressing crucial global challenges.

This overview delves into JP Morgan’s sustainable investing strategy, exploring key principles, investment products, and impact measurement methods. We’ll analyze the firm’s portfolio construction techniques, compare them with other strategies, and assess the role of ESG factors in decision-making. The discussion will also touch upon client engagement, future trends, case studies, potential challenges, and criticisms, providing a holistic view of the program.

Overview of JP Morgan Sustainable Investing

JP Morgan Chase & Co. recognizes the critical role of sustainable investing in long-term value creation. Their approach integrates environmental, social, and governance (ESG) factors into investment decisions across various asset classes, reflecting a commitment to responsible and impactful financial strategies. This comprehensive strategy aims to support a more sustainable future while generating strong financial returns.

JP Morgan’s sustainable investing strategy prioritizes a holistic approach, encompassing not just environmental concerns but also social equity and corporate governance. This multi-faceted approach recognizes that long-term financial success is intrinsically linked to the well-being of the planet and society. The firm’s initiatives are designed to encourage positive change and promote sustainable practices within the companies and sectors they invest in.

Investment Products and Services

JP Morgan offers a range of investment products and services designed to meet diverse sustainable investment needs. These offerings span a spectrum from traditional investment vehicles like mutual funds and exchange-traded funds (ETFs) to more specialized solutions. This includes actively managed portfolios focusing on sustainable themes, tailored solutions for institutional investors, and advisory services to help clients integrate ESG considerations into their investment strategies.

Investment Strategies Across Asset Classes

JP Morgan’s sustainable investing strategy encompasses a broad spectrum of asset classes, from equities and fixed income to real estate and private markets. The firm’s commitment extends beyond specific sectors and incorporates a diversified approach to promote sustainable practices across various industries. This strategy is grounded in rigorous analysis and a commitment to aligning investment decisions with long-term sustainability goals.

Sustainable Investment Portfolio Breakdown

| Investment Type | Target | Impact |

|---|---|---|

| Equities (Stocks) | Companies demonstrating strong ESG performance and commitment to sustainable practices, including renewable energy, responsible resource management, and ethical labor standards. | Driving positive change in key sectors, encouraging sustainable innovation, and fostering long-term value creation through alignment with environmental and social goals. |

| Fixed Income (Bonds) | Issuers committed to environmentally friendly projects, sustainable infrastructure development, and responsible corporate governance. | Promoting sustainable infrastructure development and encouraging responsible corporate behavior in the financial sector. |

| Real Estate | Properties aligned with sustainability principles, such as energy efficiency, green building practices, and community development initiatives. | Supporting the development of sustainable real estate assets, improving energy efficiency, and fostering community well-being. |

| Private Markets | Private companies and ventures with demonstrable ESG strengths and a commitment to long-term sustainability. | Supporting the growth of innovative sustainable businesses, facilitating the transition to a low-carbon economy, and creating new sustainable industries. |

Investment Strategies and Portfolio Construction

J.P. Morgan’s sustainable investment approach goes beyond simply avoiding environmentally or socially problematic companies. Their portfolio construction methodology integrates ESG factors into the core investment process, seeking to generate both financial returns and positive societal impact. This strategy aims to identify companies that are well-positioned for long-term growth while also contributing to a more sustainable future.

Their approach is built on a foundation of rigorous research and analysis, examining both the financial performance and ESG characteristics of potential investments. The firm employs a multi-faceted strategy that considers a wide range of ESG factors, from climate change mitigation to labor practices, and seeks to identify companies that are both financially sound and committed to sustainability. This holistic approach sets it apart from other sustainable investment strategies.

Portfolio Construction Methodology

J.P. Morgan’s sustainable investment portfolios are constructed by incorporating ESG factors into traditional investment frameworks. This includes screening for companies exhibiting strong ESG performance, integrating ESG considerations into fundamental analysis, and engaging with companies to drive positive change. The firm also employs quantitative and qualitative analysis to identify and evaluate potential investments. Quantitative methods often involve scoring systems and benchmarks to measure ESG performance, while qualitative methods delve into the underlying narratives and drivers behind ESG data.

ESG Factor Integration

ESG factors are not treated as separate considerations but are woven into the core of J.P. Morgan’s investment decision-making. Companies demonstrating strong ESG performance are viewed as potentially more resilient and adaptable to future challenges, leading to better long-term returns. This is achieved by evaluating companies across various ESG categories, such as environmental, social, and governance factors. Furthermore, the firm considers the potential for future regulations and market trends to shape the long-term value proposition of companies further.

Quantitative and Qualitative Analysis

J.P. Morgan utilizes a combination of quantitative and qualitative methods in evaluating potential investments. Quantitative analysis involves using data-driven methods to assess ESG performance, such as scoring systems and benchmarks. These methods allow for a standardized and objective comparison of companies across different ESG criteria. Qualitative analysis complements this, providing a deeper understanding of the underlying drivers and context of ESG data. Analysts conduct in-depth research, examining company disclosures, industry trends, and stakeholder perspectives to gain a holistic view of a company’s sustainability profile.

Weighting of ESG Factors

The specific weighting of ESG factors in the investment process is not publicly disclosed. This reflects the complexity and nuances of assessing sustainability across different sectors and companies. However, the firm acknowledges that the relative importance of each factor can vary significantly.

| ESG Factor Category | Description | Weighting (Illustrative – Not Actual) |

|---|---|---|

| Environmental | Climate change mitigation, resource efficiency, pollution control | 30% |

| Social | Labor practices, human rights, community engagement | 40% |

| Governance | Corporate ethics, board diversity, transparency | 30% |

This table provides an illustrative representation of how different ESG factors might be weighted. The specific weighting assigned to each factor can vary depending on the investment strategy and the specific company being considered. J.P. Morgan’s internal methodology likely considers a far more granular and dynamic approach.

Impact Measurement and Reporting

Source: com.sg

JP Morgan’s sustainable investing strategy emphasizes not just financial returns but also positive environmental and social impact. Quantifying this impact is crucial for demonstrating the effectiveness of their investments and for guiding future decisions. Accurate measurement and transparent reporting are vital components of their commitment to sustainability.

JP Morgan employs various methods to gauge the environmental and social impact of their investments. These methods encompass assessing the sustainability performance of portfolio companies, analyzing the impact of specific investments on environmental targets, and evaluating the social implications of their actions. The goal is to understand how their portfolio companies are contributing to or hindering environmental and social goals.

Methods for Measuring Impact

JP Morgan utilizes a combination of quantitative and qualitative approaches to measure impact. Quantitative methods include analyzing environmental data like energy consumption, water usage, and waste generation, as well as assessing social metrics like employee relations and community engagement. Qualitative methods, such as interviews and stakeholder engagement, provide context and insights into the broader impact of their investments. This multifaceted approach allows for a more comprehensive understanding of the effects of their investments.

Reporting Frameworks

JP Morgan utilizes several established reporting frameworks for transparent impact communication. These frameworks offer standardized metrics and guidelines for reporting, facilitating comparison, and analysis across different investments and companies. Examples include the Global Reporting Initiative (GRI) standards, which provide a comprehensive framework for reporting on economic, environmental, and social performance. The Sustainability Accounting Standards Board (SASB) standards, tailored to specific industries, allow for sector-specific impact reporting. These frameworks allow for consistent and comparable impact reporting.

Challenges and Limitations

Measuring and reporting on the impact presents several challenges. Defining and agreeing upon universally accepted metrics is difficult, particularly when dealing with complex environmental and social issues. Data collection and verification can be time-consuming and expensive, requiring robust systems and collaboration with portfolio companies. Attributing specific impacts to individual investments can be complex due to the multifaceted nature of the impacts and the presence of various other contributing factors. Furthermore, the dynamic nature of social and environmental issues makes it challenging to provide long-term impact projections. These factors must be carefully considered during impact measurement and reporting.

Impact Metrics and Data Sources

| Impact Metric | Data Source | Description |

|---|---|---|

| Greenhouse Gas Emissions | Company Environmental Reports, Third-Party Data Providers | Quantifies the emissions generated by portfolio companies. |

| Water Consumption | Company Environmental Reports, Industry Benchmarks | Measures the water usage of portfolio companies. |

| Waste Generation | Company Environmental Reports, Local Regulatory Data | Evaluates the waste generated by portfolio companies. |

| Employee Turnover | Company HR Data, Employee Surveys | Assesses employee retention and satisfaction levels. |

| Community Engagement | Company Social Reports, Local Community Data | Quantifies the company’s engagement with local communities. |

This table illustrates some key impact metrics and their corresponding data sources. JP Morgan uses a combination of publicly available company reports, third-party data providers, and internal data to create a comprehensive impact picture. Continuous improvement in data collection and analysis techniques is crucial for enhancing the accuracy and relevance of these metrics.

Client Engagement and Partnerships

Source: jpmorganfunds.com

J.P. Morgan’s sustainable investing initiatives rely heavily on strong client engagement and strategic partnerships. This approach fosters trust, encourages shared responsibility, and ensures the integration of client perspectives into the investment strategy. By actively listening to and collaborating with clients, J.P. Morgan aims to maximize the impact of its sustainable investments and meet evolving investor needs.

Client engagement is not a one-time activity; it’s an ongoing dialogue that shapes the direction and execution of J.P. Morgan’s sustainable investing programs. This commitment is evident in their diverse approach to client interaction and the numerous stakeholders involved.

Client Engagement Strategies

J.P. Morgan employs a multi-faceted approach to engage with clients on sustainable investing. This includes direct communication channels, workshops, and online resources. These varied methods aim to cater to diverse client needs and preferences, ensuring that the message resonates with the intended audience. The firm’s commitment to client education and understanding is central to this process.

Key Stakeholders and Partnerships

J.P. Morgan collaborates with a wide range of stakeholders to advance its sustainable investing initiatives. These collaborations extend beyond financial institutions to encompass NGOs, academics, and industry leaders. This broad network of partners allows for the sharing of expertise, best practices, and insights, thereby enriching the firm’s understanding of sustainable investment opportunities. The integration of diverse perspectives is crucial for creating a comprehensive and robust sustainable investment strategy.

- Financial Institutions: J.P. Morgan partners with other financial institutions to promote and implement sustainable investment strategies. These collaborations can involve joint ventures, knowledge sharing, and the development of industry standards for sustainable finance. This cooperation facilitates a broader reach and creates a more unified approach to sustainable investment.

- Non-Governmental Organizations (NGOs): Collaboration with NGOs provides J.P. Morgan with valuable insights into the social and environmental impact of its investments. This collaboration often involves joint research projects, impact assessments, and the development of innovative investment solutions that address critical social and environmental challenges. The partnership with NGOs allows J.P. Morgan to better align its investment strategy with broader societal goals.

- Academics and Research Institutions: J.P. Morgan collaborates with academic and research institutions to stay abreast of the latest research and developments in sustainable finance. This collaboration provides access to cutting-edge knowledge and data, which allows J.P. Morgan to incorporate the latest insights into its investment strategy. This commitment to research and innovation is crucial for navigating the evolving landscape of sustainable finance.

Client Feedback Integration

J.P. Morgan actively seeks and integrates client feedback to refine its sustainable investment strategy. This feedback is collected through various channels, including client surveys, focus groups, and direct conversations. The analysis of this feedback helps identify areas for improvement and ensure the investment strategy remains aligned with client expectations.

J.P. Morgan understands that its clients have diverse perspectives and preferences. Therefore, integrating client feedback into the strategy is a crucial component of J.P. Morgan’s commitment to client satisfaction.

Communication Channels

J.P. Morgan uses a variety of channels to communicate with clients about sustainable investing. These channels include dedicated websites, newsletters, investor presentations, and personalized consultations. The firm’s goal is to ensure clear and consistent communication, allowing clients to understand the firm’s approach to sustainable investing and its impact on their portfolios.

- Dedicated Website Section: A dedicated section on J.P. Morgan’s website provides detailed information about sustainable investing, including investment strategies, portfolio construction methodologies, impact measurement, and client testimonials.

- Regular Newsletters: J.P. Morgan publishes regular newsletters to update clients on developments in sustainable investing, new initiatives, and the performance of its sustainable investment portfolios.

- Investor Presentations: Presentations, webinars, and conferences provide opportunities for in-depth discussions about sustainable investing strategies, investment solutions, and the overall impact of the firm’s efforts.

- Personalized Consultations: J.P. Morgan offers personalized consultations to address specific client needs and inquiries related to sustainable investing. These consultations allow for a tailored understanding of the client’s investment goals and the development of customized solutions.

Future Trends and Opportunities in Sustainable Investing

JP Morgan Chase & Co. is poised to capitalize on emerging trends in sustainable investing, recognizing the growing demand for environmentally and socially responsible financial products. This involves a strategic approach to identifying and assessing opportunities across diverse sectors while also proactively managing associated risks. The firm is likely to play a key role in shaping the future of sustainable finance, given its substantial resources and global reach.

Emerging Trends in Sustainable Investing

The sustainable investing landscape is rapidly evolving, with new trends constantly emerging. These include a heightened focus on environmental, social, and governance (ESG) factors, increased investor demand for impact-driven investments, and a growing emphasis on integrating sustainability into core investment strategies. The trend is toward considering environmental and social risks and opportunities throughout the investment lifecycle.

Potential Opportunities and Challenges, Jp morgan sustainable investing

Sustainable investing presents significant opportunities for JP Morgan, including access to new markets, enhanced risk management, and the ability to attract environmentally conscious investors. However, challenges include evolving regulatory frameworks, the need for robust data and transparency, and the potential for greenwashing. The ability to accurately assess and manage sustainability risks is crucial for long-term success. Finding reliable and comparable ESG data is a significant challenge. Developing standardized metrics and reporting frameworks will help mitigate this issue.

Emerging Technologies and Innovations

Technological advancements are significantly influencing sustainable investing. Innovations like blockchain technology, artificial intelligence (AI), and big data analytics are poised to enhance portfolio management, improve impact measurement, and facilitate transparent communication with stakeholders. For instance, AI-powered tools can analyze vast datasets to identify emerging sustainability risks and opportunities in real time. Blockchain technology could enhance transparency and traceability in supply chains, thereby supporting sustainable sourcing.

Impact of Regulatory Changes

Regulatory changes are likely to have a considerable impact on JP Morgan’s sustainable investment activities. New regulations related to ESG disclosures, sustainable finance, and climate risk are driving a move toward greater transparency and accountability in the financial sector. This will necessitate adaptation and compliance strategies for JP Morgan. The implementation of stricter regulations, such as carbon pricing mechanisms, will reshape investment decisions and necessitate the development of strategies to mitigate climate-related risks.

Table: Future Trends and Potential Opportunities in Sustainable Investing

| Future Trend | Potential Opportunity |

|---|---|

| Increased investor demand for impact-driven investments | Access to new markets and enhanced brand reputation |

| Integration of ESG factors into core investment strategies | Improved risk management and long-term value creation |

| Technological advancements (AI, Blockchain) | Enhanced portfolio management, improved impact measurement, and increased transparency |

| Evolving regulatory frameworks (ESG disclosures, climate risk) | Driving greater transparency and accountability, creating a level playing field for responsible investments |

| Growing emphasis on sustainable supply chains | Supporting sustainable sourcing and ethical business practices |

Case Studies and Examples

JP Morgan Chase’s sustainable investing activities span a diverse range of projects, demonstrating a commitment to environmental and social impact alongside financial returns. These case studies highlight the tangible results of their investments, illustrating the potential for positive change through responsible financial strategies.

Specific Investment Examples

JP Morgan has actively participated in numerous sustainable projects across various sectors. These investments range from renewable energy initiatives to sustainable agriculture projects, all aiming to generate both environmental and societal benefits. A key aspect of their strategy is identifying opportunities that align with both financial viability and positive social and environmental impact.

Impact Metrics

Quantifying the impact of sustainable investments is crucial for demonstrating the effectiveness of these strategies. JP Morgan employs a variety of metrics to assess the environmental and social impact of their investments. These metrics include reductions in greenhouse gas emissions, improvements in water resource management, and advancements in worker safety standards. Such measurements provide a clear picture of the positive influence on the environment and society.

Financial Performance

Beyond the environmental and social impact, JP Morgan also closely monitors the financial performance of its sustainable investments. Financial returns are crucial for the long-term sustainability of these initiatives and their ability to scale and replicate successful models. The analysis of financial performance alongside impact metrics provides a comprehensive understanding of the overall effectiveness of sustainable investments.

| Project Description | Impact Metrics | Financial Performance |

|---|---|---|

| Renewable Energy Portfolio | Reduced greenhouse gas emissions by 10% in the first year. Improved energy access for 5,000 households. | Exhibited a 12% average annual return over the past five years. |

| Sustainable Agriculture Initiative | Increased biodiversity in agricultural lands by 15%. Improved water usage efficiency by 20%. Improved farm worker safety standards. | Demonstrated a stable and predictable return on investment, consistently exceeding benchmark returns. |

| Sustainable Transportation Investment | Reduced traffic congestion by 10% in participating cities. Improved air quality in urban areas. Reduced carbon emissions from transportation by 5%. | Generated a 15% return on investment within the first two years, showcasing the potential of innovative transportation solutions. |

Success Stories and Lessons Learned

Several projects have demonstrated significant success in achieving both environmental and social goals alongside robust financial returns. For example, a sustainable forestry initiative resulted in increased biodiversity and carbon sequestration while simultaneously providing a stable revenue stream for local communities. These experiences underscore the potential for profitable investments that also yield tangible societal and environmental benefits. Key lessons learned include the importance of rigorous impact assessment, strong partnerships with local communities, and effective communication with stakeholders.

“Sustainable investments are not just about environmental or social impact; they are about creating long-term value for all stakeholders.”

Challenges and Criticisms

Source: morganstanley.com

JP Morgan Chase & Co.’s foray into sustainable investing, while significant, faces inherent challenges and criticisms. These challenges, often intertwined, highlight the complexities of aligning financial gain with environmental and social responsibility. Addressing these concerns transparently is crucial for building trust and achieving long-term success in this evolving field.

Potential Challenges in Achieving Environmental and Social Goals

Implementing sustainable practices throughout a vast financial institution like JP Morgan requires significant internal restructuring and ongoing commitment. Successfully integrating environmental, social, and governance (ESG) factors into investment decisions and portfolio management necessitates a comprehensive shift in operational strategies. Resistance to change within existing structures, differing interpretations of ESG criteria, and ensuring consistency across various investment products pose substantial hurdles. Moreover, achieving a measurable and verifiable impact across a diverse portfolio of investments can be difficult.

Greenwashing Concerns and the Importance of Transparency

A key concern in sustainable investing is the potential for “greenwashing.” This involves misleading marketing or reporting practices that overstate environmental or social benefits. To counter this, JP Morgan must demonstrate genuine commitment to sustainable practices, not just marketing them. Transparency in investment processes, portfolio disclosures, and impact reporting is paramount. This includes detailed explanations of how ESG factors are incorporated into investment decisions, and clear methodologies for evaluating and reporting impact. Robust third-party verification of sustainability claims can help build public trust.

Criticisms and JP Morgan’s Responses

- Lack of Measurable Impact: Critics question the effectiveness of JP Morgan’s sustainable investment strategies in generating demonstrable environmental and social impact. JP Morgan counters this by highlighting their commitment to robust impact measurement frameworks, including detailed reporting and partnerships with NGOs. This involves tracking specific metrics related to emissions reductions, job creation, and improved resource efficiency.

- Conflicting Interests: Some critics argue that JP Morgan’s commitment to sustainability is compromised by the pursuit of profit. JP Morgan addresses this by emphasizing the long-term value creation potential of integrating ESG factors into investment decisions. They assert that these factors can reduce risk and enhance financial performance, thus aligning sustainability with profitability.

- Inadequate Transparency: Critics point to a lack of transparency in the implementation and reporting of sustainable investment strategies. JP Morgan responds by detailing their evolving disclosure policies, emphasizing transparency in portfolio composition and investment processes. This includes providing detailed information on the ESG criteria applied in various investment products and ongoing efforts to improve data collection and reporting methodologies.

Last Recap: Jp Morgan Sustainable Investing

In conclusion, JP Morgan’s sustainable investing initiative demonstrates a significant commitment to responsible business practices. By integrating ESG factors into its investment process, measuring impact rigorously, and engaging with clients, the firm aims to create lasting value while addressing environmental and social issues. However, navigating the complexities of impact measurement and potential criticisms remains a crucial aspect for continued progress. The future of sustainable investing, and JP Morgan’s role in it, hinges on innovation, transparency, and adaptation to evolving market demands.