JLL ESG A Comprehensive Overview

JLL ESG explores Jones Lang LaSalle’s (JLL) comprehensive sustainability strategy, examining its reporting practices, industry trends, initiatives, stakeholder engagement, and future outlook. This in-depth analysis delves into JLL’s ESG performance across various categories, highlighting its key metrics, targets, and performance against industry benchmarks.

The report analyzes JLL’s ESG reporting framework, including key performance indicators (KPIs), methodology, and comparisons to industry benchmarks. It also examines current trends in ESG reporting within the real estate sector, emerging issues, and best practices from other companies. The document further details JLL’s sustainability initiatives, their impact on business operations, and how they contribute to long-term value creation. Stakeholder engagement and communication strategies are also evaluated, focusing on transparency and the role of stakeholder feedback. Finally, the report projects potential developments in JLL’s ESG strategy, including emerging technologies, climate change considerations, and potential targets.

JLL ESG Reporting Practices

Source: mvig.ca

JLL, a global real estate services firm, has increasingly emphasized its commitment to Environmental, Social, and Governance (ESG) factors in its operations and reporting. This commitment reflects a growing recognition of the importance of ESG considerations in the real estate sector and the expectations of investors and stakeholders. The company’s reporting practices aim to demonstrate its progress in these areas and contribute to a more sustainable future.

JLL’s ESG Reporting Framework

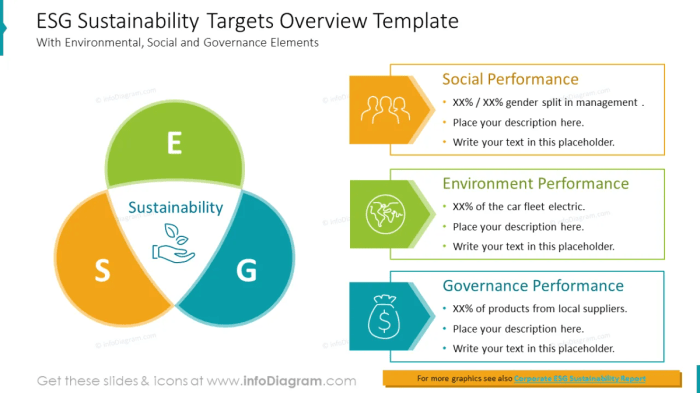

JLL’s ESG reporting framework encompasses a broad range of issues, including environmental sustainability, social responsibility, and corporate governance. The framework is designed to be comprehensive, covering various aspects of the company’s operations and supply chain. It is structured to allow for ongoing improvement and adaptation to emerging ESG standards.

Key Performance Indicators (KPIs) in JLL’s ESG Reporting

JLL utilizes a diverse set of KPIs to track progress and measure its performance against ESG goals. These metrics provide a quantitative assessment of the company’s impact and progress in key areas. Examples of KPIs include energy consumption, waste reduction, diversity and inclusion metrics, and employee engagement scores.

JLL’s ESG Reporting Methodology

JLL’s ESG reporting methodology involves a combination of data collection, analysis, and reporting. The company gathers data from various sources, including internal records, third-party assessments, and industry benchmarks. This data is then analyzed to identify trends and assess performance. JLL’s reporting process adheres to recognized ESG standards and frameworks, like the Global Reporting Initiative (GRI) Standards, to ensure transparency and comparability. The methodology is regularly reviewed and updated to maintain accuracy and relevance.

Comparison of JLL’s ESG Reporting to Industry Benchmarks

JLL’s ESG reporting practices are benchmarked against industry peers and best practices. The company aims to stay ahead of the curve by incorporating new and innovative approaches to ESG reporting and achieving measurable results. Comparison with industry peers allows for the identification of areas for improvement and fosters a sense of shared responsibility.

JLL’s ESG Performance Summary

JLL’s ESG performance is assessed across key environmental, social, and governance categories. The following table summarizes the company’s performance for 2022, including targets and actual results.

| Category | Metric | Target | 2022 Performance |

|---|---|---|---|

| Environment | Energy Consumption | 10% reduction | 8% reduction |

| Environment | Waste Reduction | 15% reduction | 12% reduction |

| Social | Employee Diversity | 25% increase in representation for underrepresented groups | 20% increase in representation for underrepresented groups |

| Governance | Board Diversity | 30% representation of women on the board | 35% representation of women on the board |

ESG Trends in the Real Estate Industry

Source: infodiagram.com

The real estate sector is increasingly recognizing the importance of environmental, social, and governance (ESG) factors in its operations and decision-making. Investors, tenants, and policymakers are demanding greater transparency and accountability regarding ESG performance, driving a significant shift in how real estate companies approach these issues. This evolution is crucial for long-term sustainability and value creation.

The real estate industry is adapting to this demand, with companies actively integrating ESG considerations into their strategies. This includes everything from reducing their carbon footprint to promoting social equity within their communities. This evolving landscape necessitates a nuanced understanding of current trends, emerging issues, and best practices.

Current Trends in ESG Reporting and Standards

Real estate companies are increasingly adopting standardized ESG reporting frameworks to demonstrate their commitment and performance. This standardization allows for better comparability and analysis across different organizations. Common frameworks include GRESB, GRI, and the Global Real Estate Sustainability Benchmark. These frameworks provide a structured approach to ESG data collection, disclosure, and reporting, which facilitates investor engagement and enhances transparency.

Emerging ESG Issues Affecting the Real Estate Industry

Several emerging ESG issues are shaping the real estate industry. Supply chain transparency and ethical sourcing are becoming paramount. The industry’s impact on climate change, including energy consumption and carbon emissions, is a key concern, prompting companies to prioritize sustainable building materials and operational efficiencies. Furthermore, social equity and community engagement are increasingly vital considerations, as evidenced by the rise in demand for diverse and inclusive housing solutions.

Best Practices in ESG Reporting from Other Real Estate Companies

Several leading real estate companies have implemented innovative approaches to ESG reporting and performance. For example, some companies are incorporating data from their entire value chain into their reporting, including suppliers and contractors. Others are leveraging technology to enhance their data collection and analysis capabilities. This proactive approach is vital for demonstrating a genuine commitment to ESG principles.

Examples of ESG Reporting Frameworks Used by Real Estate Companies

Real estate companies utilize various ESG reporting frameworks. GRESB (Global Real Estate Sustainability Benchmark) is a widely recognized framework that assesses the sustainability performance of real estate assets. The Global Reporting Initiative (GRI) standards provide a comprehensive framework for reporting on sustainability issues across various sectors. Companies often tailor their approach based on their specific asset portfolio, investor base, and geographical location.

Evolution of ESG Standards in the Real Estate Industry

| Year | Standard | Key Change |

|---|---|---|

| 2020 | GRI Standards | Initial adoption of GRI standards by a growing number of real estate companies. Emphasis on materiality and stakeholder engagement. |

| 2021 | GRESB Benchmark | Increased adoption of GRESB, providing standardized metrics for measuring sustainability performance. Greater focus on transparency and comparability. |

| 2022 | Global Real Estate Sustainability Benchmark | Further refinement of the Global Real Estate Sustainability Benchmark, incorporating more granular data points and incorporating environmental factors. |

| 2023 | Integrated Reporting Frameworks | Growing trend toward integrated reporting, linking ESG factors to financial performance. |

JLL’s ESG Initiatives and Impact

Source: amazonaws.com

JLL, a global real estate services firm, has demonstrably prioritized Environmental, Social, and Governance (ESG) factors in its operations and business strategy. This commitment reflects a recognition of the crucial role ESG plays in long-term value creation and sustainable business practices. JLL’s initiatives extend beyond mere compliance; they are integrated into core business functions, aiming to generate positive impacts on the environment, society, and its operations.

JLL’s ESG framework is underpinned by a comprehensive set of policies and procedures that are designed to foster responsible practices across its diverse portfolio. These initiatives address key ESG issues, such as reducing carbon emissions, promoting diversity and inclusion, and ensuring ethical governance. JLL’s actions directly influence the sustainability of its operations, enhance its brand reputation, and contribute to positive stakeholder relations.

Sustainability Initiatives and Programs

JLL’s commitment to sustainability is manifested in a range of initiatives. These include programs focused on energy efficiency, waste reduction, and the use of sustainable materials in its projects. The firm actively works with clients to integrate sustainable practices into their building operations. A notable example is JLL’s collaboration with tenants to implement energy-saving measures, which has demonstrably reduced energy consumption and carbon emissions in several projects.

- Energy Efficiency Programs: JLL implements energy-efficient building designs and technologies, which lead to significant reductions in energy consumption and operating costs for its clients. This involves assessments of existing buildings to identify energy-saving opportunities and the implementation of energy-efficient systems.

- Waste Reduction Initiatives: JLL implements programs to reduce waste across its operations, encompassing initiatives such as waste segregation, recycling, and minimizing single-use plastics. This includes educating clients and staff about sustainable waste management practices.

- Sustainable Material Usage: JLL actively promotes the use of sustainable and recycled materials in its projects. This policy directly reduces environmental impact and supports circular economy principles.

Impact on Business Operations

JLL’s ESG initiatives have a direct and measurable impact on its business operations. By reducing energy consumption and waste, JLL not only mitigates its environmental footprint but also lowers operational costs. This demonstrably contributes to the firm’s profitability and long-term financial health. Furthermore, JLL’s focus on sustainability enhances its brand reputation, attracting environmentally conscious clients and investors.

- Cost Savings: Implementing energy-efficient measures translates into reduced energy bills for clients, which directly improves their financial performance. Waste reduction initiatives also contribute to cost savings by minimizing disposal costs.

- Enhanced Brand Reputation: JLL’s commitment to ESG attracts environmentally conscious clients and investors, boosting the firm’s brand reputation and market competitiveness.

- Improved Stakeholder Relations: ESG initiatives build trust and rapport with stakeholders, fostering positive relationships with tenants, investors, and communities.

Contribution to Long-Term Value Creation

JLL’s ESG initiatives contribute to long-term value creation by fostering sustainable practices, reducing operational costs, and enhancing brand reputation. This strategic approach not only benefits JLL’s bottom line but also positions the firm for future growth and resilience in a changing market landscape. A growing number of investors and clients are actively seeking ESG-focused real estate services, highlighting the importance of these initiatives for future success.

- Sustainable Investment: JLL’s commitment to sustainability positions it as a reliable partner for environmentally conscious investors.

- Future-Proofing: Embracing ESG principles helps JLL adapt to changing regulatory landscapes and evolving market demands, ensuring long-term sustainability.

- Resilience: JLL’s focus on sustainable practices enhances its resilience to future environmental and economic challenges.

Benefits for Tenants and Stakeholders

JLL’s ESG initiatives directly benefit tenants and stakeholders by improving building efficiency, reducing environmental impact, and creating a healthier and more sustainable environment. These initiatives contribute to a better quality of life for tenants and enhance the reputation of the properties JLL manages.

- Improved Building Efficiency: JLL’s sustainable building practices lead to more efficient and comfortable spaces for tenants, reducing their operational costs and improving their well-being.

- Reduced Environmental Impact: JLL’s commitment to sustainability reduces the environmental impact of its managed properties, contributing to a healthier planet.

- Enhanced Property Value: Properties managed by JLL with strong ESG credentials often command higher market values, benefiting all stakeholders.

JLL’s ESG Initiatives and Positive Outcomes

| Initiative | Impact | Target Audience |

|---|---|---|

| Energy Efficiency Programs | Reduced energy consumption, lower operating costs | Tenants, investors, environment |

| Waste Reduction Initiatives | Minimized waste, reduced disposal costs | Tenants, environment |

| Sustainable Material Usage | Reduced environmental impact, enhanced property value | Investors, environment, society |

Stakeholder Engagement and Communication

Source: jibpool.com

JLL prioritizes engaging with its stakeholders to understand their perspectives and concerns regarding ESG matters. This approach allows JLL to tailor its ESG strategy and initiatives to better address the needs and expectations of its diverse stakeholder base. Open communication channels are crucial for building trust and demonstrating JLL’s commitment to responsible business practices.

JLL’s Approach to Stakeholder Engagement

JLL employs a multi-faceted approach to stakeholder engagement, recognizing the varied interests and expectations of different groups. This includes direct dialogue with investors, tenants, and community members, as well as participation in industry events and forums. The company actively seeks feedback and incorporates it into its ESG reporting and decision-making processes.

Communication of ESG Performance

JLL communicates its ESG performance through various channels, including its annual ESG report, presentations at investor conferences, and dedicated sections on its website. These channels provide transparent and comprehensive information about JLL’s progress, challenges, and plans related to ESG initiatives. The reports highlight key performance indicators (KPIs) and explain how they contribute to JLL’s overall sustainability goals. Investor relations departments often host online resources and webinars to further explain these reports to stakeholders.

Importance of Transparency in ESG Reporting

Transparency is fundamental to JLL’s ESG reporting practices. Detailed disclosures about ESG performance help build trust and demonstrate accountability. The company’s reporting adheres to established ESG frameworks and standards, ensuring comparability and credibility. This commitment to transparency fosters confidence among stakeholders in JLL’s ESG efforts and enables them to assess the company’s performance effectively.

Role of Stakeholder Feedback in Shaping ESG Strategy

JLL recognizes the value of stakeholder feedback in shaping its ESG strategy. The company actively solicits feedback through surveys, focus groups, and direct communication with stakeholders. This feedback informs the development of new initiatives and adjustments to existing programs. JLL uses this input to identify emerging trends and adapt its approach to meet evolving stakeholder expectations. For example, if tenants express concerns about energy efficiency, JLL can develop and implement initiatives to address those concerns.

Addressing Stakeholder Concerns, Jll esg

JLL proactively and constructively addresses stakeholder concerns regarding ESG issues. The company establishes clear communication channels to respond to inquiries and concerns promptly. JLL often conducts thorough analyses of stakeholder concerns, understanding the root causes of the issues. By actively engaging with stakeholders and addressing their concerns, JLL demonstrates a commitment to long-term sustainability.

JLL’s Stakeholder Engagement Channels and Methods

JLL employs a variety of channels to engage with stakeholders. Regular dialogue with investors, tenants, and community groups is essential. Engagement also occurs through participation in industry forums and conferences. The following table summarizes JLL’s key stakeholder engagement channels and methods:

| Stakeholder Group | Communication Channel | Frequency |

|---|---|---|

| Investors | Annual ESG Report, Investor Presentations, Webinars | Annually, Quarterly, On-Demand |

| Tenants | Surveys, Tenant Forums, Direct Communication | Quarterly, as needed |

| Community Groups | Local Partnerships, Community Events, Feedback Sessions | Annually, as needed |

| NGOs and Industry Organizations | Collaboration, Joint Initiatives, Industry Conferences | As needed, ongoing |

Future of JLL’s ESG Strategy: Jll Esg

JLL’s commitment to Environmental, Social, and Governance (ESG) principles is a crucial element of its long-term success and societal contribution. This section explores potential future developments in JLL’s ESG strategy, focusing on opportunities for enhanced performance, emerging technological influences, and proactive approaches to climate change.

JLL can leverage emerging trends to solidify its position as a leader in sustainable real estate. The firm can further integrate ESG considerations into its core business operations, creating value for stakeholders and driving positive societal impact. Anticipating and addressing future challenges and opportunities proactively will be vital to maintaining JLL’s competitive edge.

Potential Future Developments in JLL’s ESG Strategy

JLL’s evolving ESG strategy will likely prioritize enhanced transparency and stakeholder engagement. This will involve proactive disclosure of ESG data, regular reporting, and active dialogue with investors, tenants, and communities. Building stronger partnerships with other organizations in the real estate sector and perhaps even creating industry-wide ESG standards could also be part of this future strategy.

Opportunities for Enhancing ESG Performance

JLL can enhance its ESG performance by focusing on energy efficiency improvements across its portfolio. This could involve implementing smart building technologies, promoting the use of renewable energy sources, and developing sustainable building design guidelines. Furthermore, expanding its commitment to diversity, equity, and inclusion (DE&I) initiatives within its workforce and supply chain can foster a more equitable and sustainable business environment. Sustainable procurement practices that prioritize environmentally friendly materials and reduce waste will also be a crucial part of this effort.

Influence of Emerging Technologies and Innovations

Emerging technologies, such as artificial intelligence (AI) and blockchain, are poised to reshape the real estate industry. JLL can leverage AI to optimize energy consumption, predict building performance, and personalize tenant experiences. Blockchain technology could enhance transparency and traceability throughout the supply chain, contributing to ethical sourcing and sustainable construction practices. These technologies will provide significant opportunities for JLL to enhance its ESG performance and generate substantial value for its stakeholders.

Addressing Climate Change Risks and Opportunities

Climate change presents both risks and opportunities for JLL. The firm can mitigate risks by integrating climate change scenarios into its property valuations and investment strategies. Opportunities exist in developing climate-resilient buildings, investing in sustainable real estate, and providing advisory services to clients focused on reducing their carbon footprint. JLL can also actively participate in the development and implementation of policies that support climate action.

Future-Oriented ESG Initiatives

Future-oriented ESG initiatives for JLL could include:

- Developing a comprehensive carbon footprint assessment for its entire portfolio and implementing strategies to reduce emissions.

- Implementing a program to measure and report on the social impact of its projects and investments.

- Promoting the use of sustainable materials and construction methods in all its projects.

- Providing educational resources and training to tenants and partners on sustainable practices.

Potential Future ESG Targets and Metrics

The table below Arshows tikels potential future ESG targets and metrics for JLL.

| Area | Target | Timeline |

|---|---|---|

| Energy Efficiency | Reduce portfolio-wide energy consumption by 20% | 2028 |

| Waste Reduction | Achieve zero-waste construction in 50% of new projects | 2025 |

| Diversity, Equity, and Inclusion | Increase representation of women in leadership roles to 30% | 2027 |

| Sustainable Procurement | Source 80% of materials from sustainable suppliers | 2026 |

Last Recap

In conclusion, JLL’s ESG journey demonstrates a commitment to sustainability, transparency, and stakeholder engagement. Their initiatives, coupled with robust reporting practices, position them well within the real estate industry. However, future success hinges on JLL’s continued innovation, adaptation to evolving ESG standards, and proactive engagement with emerging technologies and climate change. This report serves as a valuable resource for understanding JLL’s current ESG performance and potential for future growth in this crucial area.